Payment Processing Consulting

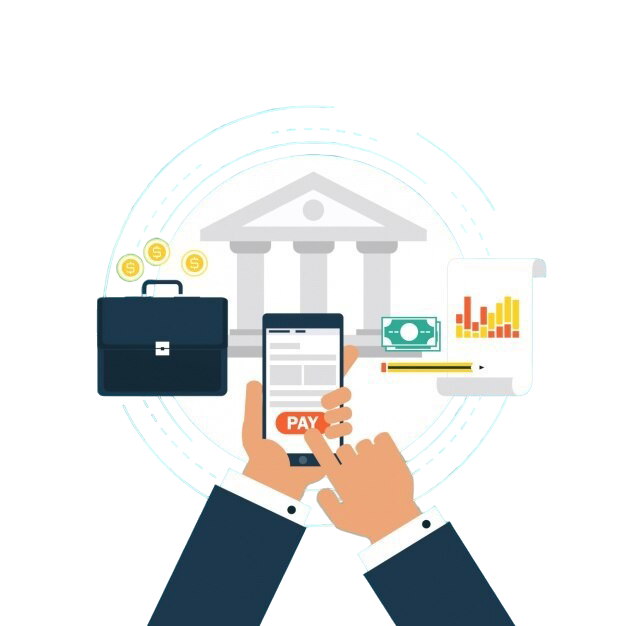

Payment processing consultants help businesses to manage global transactions. Through specialized payment processing consulting, they help companies to overcome the complexities of payment systems. A skilled payment processing consultant can identify ways to reduce transaction costs, streamline operations & maintain compliance with evolving regulations. With reliable payment consulting services, businesses can optimize their payment strategies & improve overall efficiency.

At Techzert, we provide expert payment processing consultant services to fintech companies & merchants. As a leading payment consulting services provider offer the best guidance throughout the entire payment ecosystem, streamlining processes for boosting security. Our experts specialize in creating effective payments strategies, optimizing real-time payments & offering cross-border payment solutions.

Whether you are looking for payment consulting firms in the USA, UK or Europe to understand the unique challenges of each region & provide tailored solutions. Additionally, we offer global payments consulting with expertise in Asia-Pacific markets to help clients expand their payment infrastructure and gain a competitive edge in this rapidly growing region.

Our services deliver valuable insights & practical solutions to improve operational efficiency, reduce risks, and increase profitability. Whether you're modernizing your payment systems, enhancing cross-border transactions or improving real-time payment capabilities. We helps you create solutions that align with your business goals & market needs. Let us future-proof your payment infrastructure and drive operational efficiency with innovative solutions that enhance customer experience and mitigate risks.

USA | INDIA | MIDDLE EAST | HONG KONG

USA | INDIA | MIDDLE EAST | HONG KONG